-

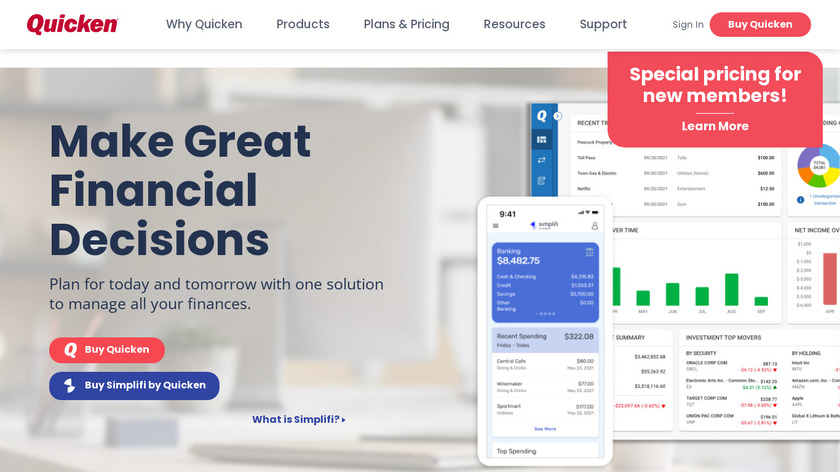

Stay in control of your monthly cash flows, budgets, and expenditures. Quicken provides a navigable interface where you can organize your debit, credit, and savings, and build good habits accordingly.

Quicken was once the go-to budgeting tool. I used it when it was first released in the 1980s. Today, it’s been eclipsed by apps that enable you to manage every aspect of your finances, often for free. Here are the best Quicken alternatives to consider in 2021.

#Personal Finance #Finance #Financial Planner 12 social mentions

-

Our vision is to transform financial lives through advice, people and technology. Our mission is to empower financial freedom for all.

Personal Capital–It’s both free and comes with the a robust set of features unmatched by other alternatives. It easily handles budgeting, net worth, cash flow, retirement investments and taxable investments. It also comes with excellent tools, including a retirement calculator, investment fee analyzer and investment portfolio analyzer. Personal Capital can now even track Bitcoin, Ethereum, Litecoin and thousands of other tokens. It’s the tool I use every day.

#Finance #Personal Finance #Financial Planner

-

The only service that automatically imports financial transactions into a spreadsheet daily.

I don’t know how they do it, but Tiller Money has figured out how to turn a Google Sheet into a dynamic budgeting tool. You link your bank accounts and credit cards to Tiller’s Google Sheet tool, and it automatically downloads all of your transactions. From there you can create budgets, categorize spending and generate reports.

#Budgeting And Forecasting #Data Dashboard #Financial Performance Management 6 social mentions

-

Working hard with nothing to show for it? Use your money more efficiently and control your spending and saving with the YNAB app.

One of YNAB’s core principles is to give every dollar a job. You do that by deciding how you’ll spend every dollar that enters your checking account. As with other tools, you can connect your bank accounts and credit cards to YNAB. This allows for real-time updates so that you can track your spending throughout the month.

#Personal Finance #Finance #Accounting & Finance

-

Smart budgeting & personal finance software

PocketSmith started out as a calendar to plan upcoming income and expenses. Today, it’s a full-fledged budgeting app. You can synch your accounts with PocketSmith. Once synced, you can track your budget and you’re net worth. You can also see your income and spending in a handy calendar view.

#Personal Finance #Finance #Budgeting 1 social mentions

-

Online personal finance website. Think of CountAbout as your Quicken or Mint alternative.

CountAbout enables you to download transactions from your bank and customize both income and expense categories. You can even attach receipt images to expense transactions. You can set up recurring transactions and generate financial reports.

#Personal Finance #Finance #Financial Planner 2 social mentions

-

Moneydance is a powerful yet easy to use personal finance app for Mac, Windows, Linux, iPhone and iPad.

With so many apps going online, Moneydance takes a different approach. You download Moneydance software rather than use it online. Once downloaded, the software works much like you would expect.

#Personal Finance #Finance #Financial Planner 22 social mentions

-

Budgeting and expense tracking app

For those Dave Ramsey founds out there, EveryDollar may be a good substitute for Intuit’s Quicken. Now the first thing to point out is that EveryDollar ain’t cheap. After a 14-day trial, you’ll pay $129.99 a year. If you want to try it for just 3 months, it will cost $59.99. For this reason, it’s not high on my list. Still, I know that some folks are passionate about Financial Peace University.

#Personal Finance #Finance #Budgeting 11 social mentions

-

Budgeting and personal finance app

You can import transactions from your bank and sync data across all of your Mac devices. Banktivity also tracks investments and offers account-level reporting. You can try Banktivity for free for 30 days. After that they offer three plans ranging in price from $4.16 to $8.33 a month (billed annually).

#Personal Finance #Finance #Financial Planner

-

A personal and small-business financial-accounting software, licensed under GNU/GPL and available for Linux, Windows, Mac OS X, BSD, and Solaris.Pricing:

- Open Source

For those who tracked business income and expenses with Quicken and a reluctant to move up to Quickbooks, GnuCash may be the answer. It uses double-entry accounting, ideal for businesses and accounting nerds, like me. It tracks investments, schedules transactions, and generates reports and graphs.

#Personal Finance #Accounting #Small Business 38 social mentions

-

Free personal finance software to assist you to manage your money, financial planning, and budget planning tools. Achieve your financial goals with Mint.

I used Mint when it first came out more than a decade ago. Today, many are looking for Mint alternatives, including several of the apps listed here. Still, Mint is a worth consideration if you are replacing Intuit’s Quicken. It’s free, for starters. It’s easy to link your accounts and track your spending. It includes a budget planner and credit score tracker. Of course, there are great Mint alternatives as well.

#Finance #Personal Finance #Financial Planner 80 social mentions

-

A home budget app based on the envelope budget system. Available on the web, Android, and iPhone.

I’m old enough to remember the envelope method of budgeting. My mom used it. When the money in the grocery envelope ran out, we stopped going to the grocery story until payday (seriously). Today, the envelope budget is still a smart way to manage money for those living paycheck-to-paycheck. If you want a digital version of the time-tested budgeting system, give GoodBudget a try.

#Personal Finance #Finance #Budgeting 25 social mentions

Discuss: 11 Best Quicken Alternatives in 2021 (#1 is Free)

Related Posts

Billing & Invoicing (Jun 25)

saashub.com // 3 months ago

Top 4 Best QuickBooks Hosting Providers For 2025

oneupnetworks.com // about 1 year ago

Vyapar vs MargERP: A Simple Comparison of Accounting Software

workspacetool.com // 5 months ago

Tally vs Busy: Which Accounting Software is Better For Your Business?

workspacetool.com // 5 months ago

Accounting (Feb 5)

saashub.com // 8 months ago

Top 10 Best Open Source Accounting Software Comparison 2024

crm.org // over 1 year ago