150 ChatGPT 4.0 prompts for SEO

- Unlock the power of AI to boost your website's visibility.

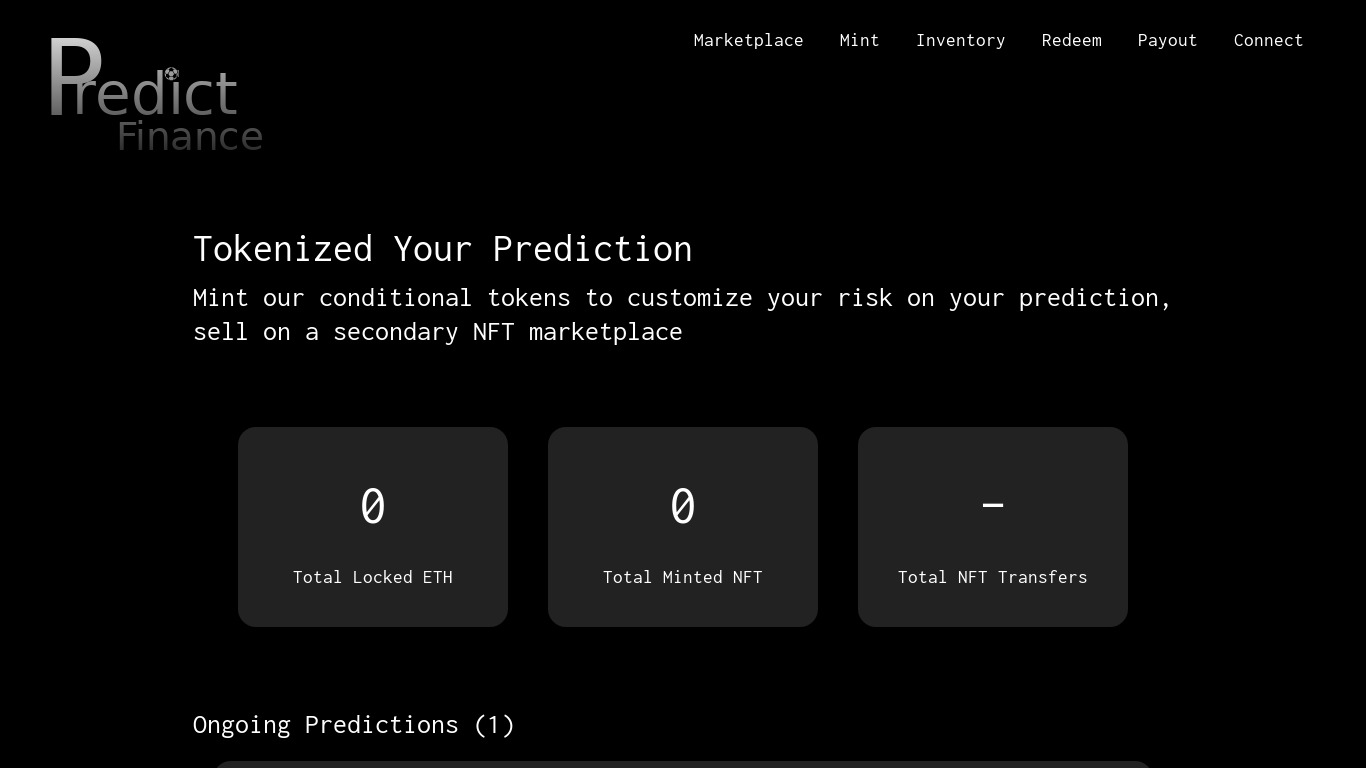

Mint

- Free personal finance software to assist you to manage your money, financial planning, and budget planning tools. Achieve your financial goals with Mint.

Finny

- Finance tools for everyday life

HomeBank

- Access Financial Services. Easy, fee-free banking for entrepreneurs Get the financial tools and insights to start, build, and grow your business.

Digit

- SMS bot that monitors your bank account & saves you money

GnuCash

- A personal and small-business financial-accounting software, licensed under GNU/GPL and available for Linux, Windows, Mac OS X, BSD, and Solaris.