-

Australia's largest digital investment adviser. We help you build and manage a personalised portfolio tailored to your financial situation and goals. It's professional investment advice without the high costs of seeing a human adviser.

At present there are 4 robo-advisers operating in Australia – Stockspot, Quiet Growth, Clover and Sixpark. Stockspot was the first to hit the market with the others quickly following suit.

#Robo-Advisor #Automated Investment #Finance

-

Clover is your personalised investment advisor. We recommend, build and grow your personalised investment portfolio all for a low fee. Try Clover now!

At present there are 4 robo-advisers operating in Australia – Stockspot, Quiet Growth, Clover and Sixpark. Stockspot was the first to hit the market with the others quickly following suit.

#Robo-Advisor #Automated Investment #Personal Finance

-

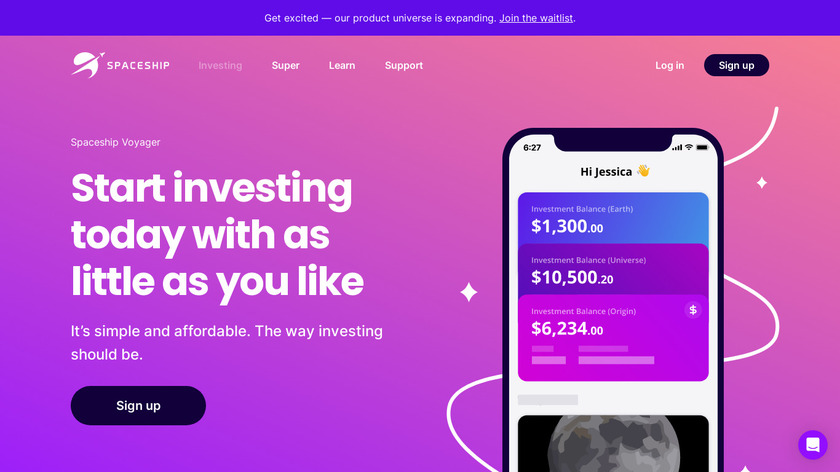

Investing with Spaceship Voyager is free under $5,000 and there is no minimum investment. Choose between Spaceship Index and Spaceship Universe.

As you can see – at fees of just 0.05% and .10% above $5,000 (and free below $5,000) the new product blows even Raiz out of the water from a fee perspective (there aren’t even ETF fees with Spaceship Voyager). Adding Voyager to the comparison table you can see a fee saving of $16,000:

#Investing #Automated Investment #Index Fund Investment

-

QuietGrowth is a digital investment management service or robo advisor. It manages the investments of clients to achieve risk-optimised returns over the long term.Pricing:

- Paid

#Automated Investment #Robo-Advisor #Robo Advice

-

NOTE: Six Park has been discontinued.Create your very own globally diversified, professionally managed portfolio of investments online today.

#Robo-Advisor #SMSF #Automated Investment

-

Invest spare change automatically from everyday purchases into a diversified portfolio.

We haven’t mentioned Raiz as a robo-advice company because they miss a key component – the advice. While they have similar investment options and do the re-balancing they won’t tell you where to invest your money but rather you have to choose. One of the advantages of Raiz is they do cater for smaller investment amounts – but be warned; the further your balance slides below $5,000 the more expensive it is.

#Robo-Advisor #Automated Investment #Fintech 5 social mentions

-

Plenty provides personalised online financial advice. Your financial plan (for free) will help you achieve all of your financial goals. Get advice on every aspect of your financial life.

Plenty considers your investments within the scope of your entire financial life – we will not only tell you where to invest but also how much to invest and whether investing is the right option given your other debts, goals in life and overall financial picture. (Note: at present we don’t have the capability to invest your money automatically but when we do our costs will be low.)

#Personal Finance #Robo-Advisor #Finance

Discuss: Robo-Advisers Australia - Raiz vs Stockspot Vs The Rest

Related Posts

Pepperstone vs ActivTrades UK Broker Comparison

tradingbrokers.co.uk // 10 months ago

Best Social Trading App: NVSTly vs. Xtrades Showdown

medium.com // over 1 year ago

Investing (Nov 8)

saashub.com // 11 months ago

13 BEST TradingView Alternative for Equity, Crypto & Forex

guru99.com // almost 2 years ago

TradingView Alternatives 2024: Best Paid & Free Competitors

thesovereigninvestor.net // about 2 years ago

We Have Tried These 6 Free TradingView Alternatives

medium.com // almost 2 years ago