GST

The best GST Products based on votes, our collection of reviews, verified products and a total of 35 factors

Top GST Products

-

/vyaparapp-in-alternatives

Business now on your finger tips!

-

/catsbill-alternatives

Catsbill.com allows its customers to generate GST compliant invoices. It is super easy and a LIFETIME FREE SOFTWARE providing you all the features.

-

/iris-gst-alternatives

"Simple and hassle-free GST solutions for mid and large businesses | GST filing solution, EWay Bill software, GSTIN Search, API Integration etc."

-

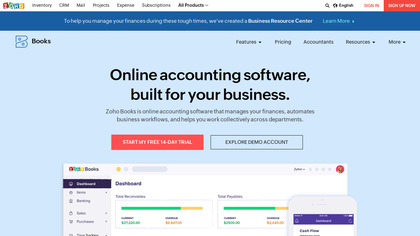

/zoho-books-alternatives

Smart Accounting for Growing Business

-

/ceaar-alternatives

Ceaar Cloud Records is online accounting software for small businesses in India. Login to Ceaar Software to manage GST invoicing, manage business accounts, track receivables, track cashflow in bank accounts, run payroll & more. Start a free trial

-

/gsthero-alternatives

GSTHero provides 100% online GST Return filing, GSTR 2A/2B Reconciliation Software, e-Invoice Software, and e-Way Bill Automation Software

-

/cleartax-gst-software-alternatives

Cleartax GST software is used for the business purposes that are both SaaS and cloud-based software.

-

/refrens-invoices-alternatives

The New Way To Run Your Business

-

/gst-generator-alternatives

Online invoice generator to create GST-compliant invoices. Follows the GST invoice format as suggested by CBEC. Users can manage previous invoices and track payments as well.

-

/gogstbill-alternatives

GoGSTbill is the fast working GST billing software that comes with a lot of features to manage your business accurately.

-

/utilitybillingonline-com-alternatives

UtilityBillingOnline.com 'Web-Based Utility Billing Software and Mail/Printing Service'

-

/publiccalculators-com-alternatives

This Online GST calculator calculates your payable GST amount. Don't worry about how GST calculation works out.

-

/mybillbook-in-alternatives

No.1 Billing Software for Small Businesses in India, Free Download. 60 Lakh+ Businesses Created GST Bills & Invoices with myBillBook Billing Software and increased Business. GST Billing Software for Bharat.