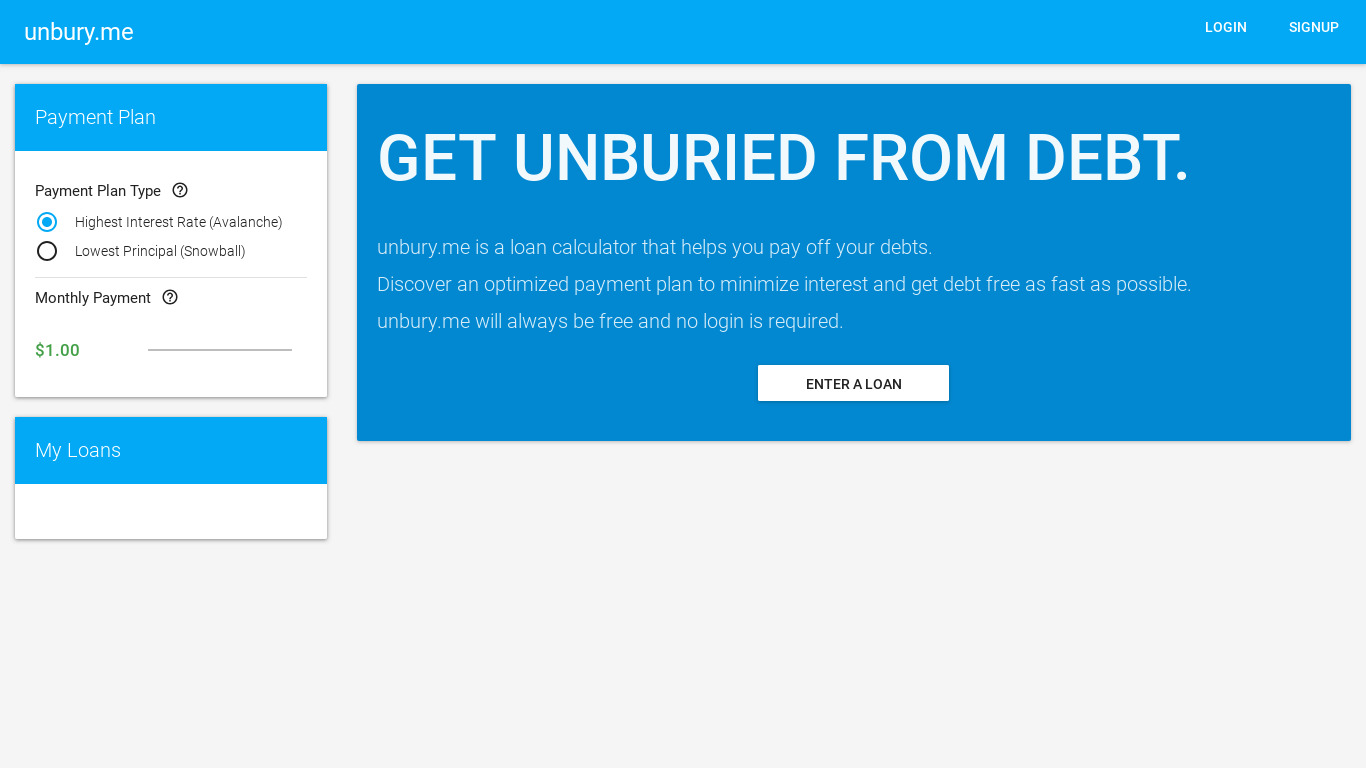

Unbury Me Reviews and details

Screenshots and images

Videos

Unbury Me 2-5-12

Social recommendations and mentions

We have tracked the following product recommendations or mentions on various public social media platforms and blogs.

They can help you see what people think about Unbury Me and what they use it for.

-

I work for some of the richest people in my town. I’m so bitter about it.

Look into the snowball vs avalanche methods for debt repayment (see here for an article overview and here for a reddit discussion). Figure out which one is more likely to be more helpful to you given your current financial situation and make a payment plan based on whichever method you decide to follow. Given that you're visibly struggling with cash flow, I'd tentatively recommend the snowball method (at least, at... Source: 11 months ago

-

Credit card debt game plan advice please :)

You can run the scenarios here though... https://unbury.me/. Source: 11 months ago

-

Improvements: New job and ability ( money) to pay down pressing credit card debts.Which should I prioritize first?

If you want to compare the two methods lookup avalanche vs snowball. Here is a calculator to help guide you: https://unbury.me/. Source: 11 months ago

-

25 and Paycheck to Paycheck

With that said, I would also recommend that the two of you start doing your finances together, and both have an accurate overview of all of your assets, all of your debts, all of your financial obligations. Then the two of you together can start making decisions on how to move forward. And you can support each other in making the right choices along the way. A debt calculator could help you understand how long it... Source: 11 months ago

-

45K debt at 23; making 22/hour, don't qualify for debt consolidation. Any advice?

I recommend https://unbury.me - great tool to help you plan paying off your debt. Source: 12 months ago

-

It's Graduation Day: $305,000.00 Debt

Https://unbury.me is an excellent tool for visualizing the optimal paydown strategy. Source: 12 months ago

-

Which method ?

Here’s a great tool that can help you plan how to pay off your debt. Strongly recommend the snowball method. https://unbury.me/. Source: 12 months ago

-

Working two jobs and still can't afford my bills.

Consider reaching out to workforce development organizations. Maybe the problem is your resume, and they can help you improve it. Maybe they'll know about other job opps. Work it! You don't have to make much more to break even. It seems too soon to be considering bankruptcy. You didn't say what the total amount of your debts are, though. Run them through https://unbury.me/ and figure out the best order in which to... Source: almost 1 year ago

-

Credit card Debt hole

Check out https://unbury.me to see how fast you can pay this off. Source: about 1 year ago

-

$80K in CC Debt, need advice

Obviously, create a budget and then tune it as you get better at keeping track of your expenses. Money is a limited resource, it needs a plan and the budget forms the basis of where that resource can be applied. Put that resource to work. I like https://unbury.me/ for a simple interface to put in debts and play with different scenarios and payment amounts. Source: about 1 year ago

-

Help getting out of dept.

Plug your cards balances & interest rates into unbury.me. You can put in your minimum payments on each card, then see how additional payments will shorten your payoff date. It lets you choose between avalanche and snowball payoff methods. Source: about 1 year ago

-

Financial Issue Root cause: Depression

Unbury.me is a really simple calculator that lets you plug in your debts, minimum payments and interest rates. It gives you a picture of quickly you can pay them off with extra payments and what you'll save in interest. Source: about 1 year ago

-

Debt relief programs?

Https://unbury.me can be used to make a plan; or to make an initial plan now and then every month see how much faster you're (hopefully) going than the base plan. Source: about 1 year ago

-

$25000 debt

Also, here's a handy calculator that can help you map out your debt-free day: https://unbury.me/. Source: about 1 year ago

-

Considering bankruptcy at 22

Plug your info here and play with the interest rate: https://unbury.me/. Source: about 1 year ago

-

Where do I start? Snowball vs Avalanche? Need a plan to get myself out of debt.

Https://unbury.me/ is a pretty good website that may help. It lets you enter all the debts you're dealing with and play around with different scenarios like tweaking monthly payments, avalanche vs. snowball, etc. Source: about 1 year ago

-

Any advice on how to set boundaries around lending money to family?

There are no appropriate amounts. $0 is the only appropriate amount. You worked hard for that money. They didn't. You've got debt! You could have paid that down! Paying the principal down now can cut years and thousands of dollars of debt later. Go ahead and play with https://unbury.me/ and see how much your giving has actually cost you in the long run. Source: about 1 year ago

-

Need help making a Debt plan

And yes, mathematically, paying them off largest interest rate to smallest will get the job done the fastest with the lowest amount of interest. But there's something to be said for the snowball method with trades some of that time and interest for the advantage of freeing up your discretionary payments more quickly. Use a tool like unbury.me to figure out the cost/time differences and see if they're large/small... Source: about 1 year ago

-

I've paid $1300 so far on a $4000 loan and still owe $3500. How do I get ahead of the interest?

A Reddit user whose name I can't recall created a free website that is extremely useful for playing around with how to get 'unburied' from debt. Plug in the data and see how much more than $50 you'd need to pay over the minimum in order to close the loan within the amount of time you are shooting for. unbury.me. Source: over 1 year ago

-

Consolidating Debt Into One Loan

A website like http://unbury.me can help you manage debt. Especially if you have multiple debts it can give you a nice way to see when you'll finish paying them. But in your case, it may still help you calculate when you'll be debtfree. Note the date. And then, whenever you make an extra payment, make a new calculation with the new situation (new balance) and you will see that you'll be debtfree sooner. Might be... Source: over 1 year ago

-

Need guidance in getting out of $30k in credit card debt and also hopefully boost my credit score.

You need to input the debt amount and interest rates into https://unbury.me/ and you want to pay off the card with the highest interest rate first. This will save you the most in the long run. Seeing a date when this will be paid off will help you focus and know when the pain will end. Source: over 1 year ago

Do you know an article comparing Unbury Me to other products?

Suggest a link to a post with product alternatives.

Unbury Me discussion

This is an informative page about Unbury Me. You can review and discuss the product here. The primary details have not been verified within the last quarter, and they might be outdated. If you think we are missing something, please use the means on this page to comment or suggest changes. All reviews and comments are highly encouranged and appreciated as they help everyone in the community to make an informed choice. Please always be kind and objective when evaluating a product and sharing your opinion.