✓

Paidnice

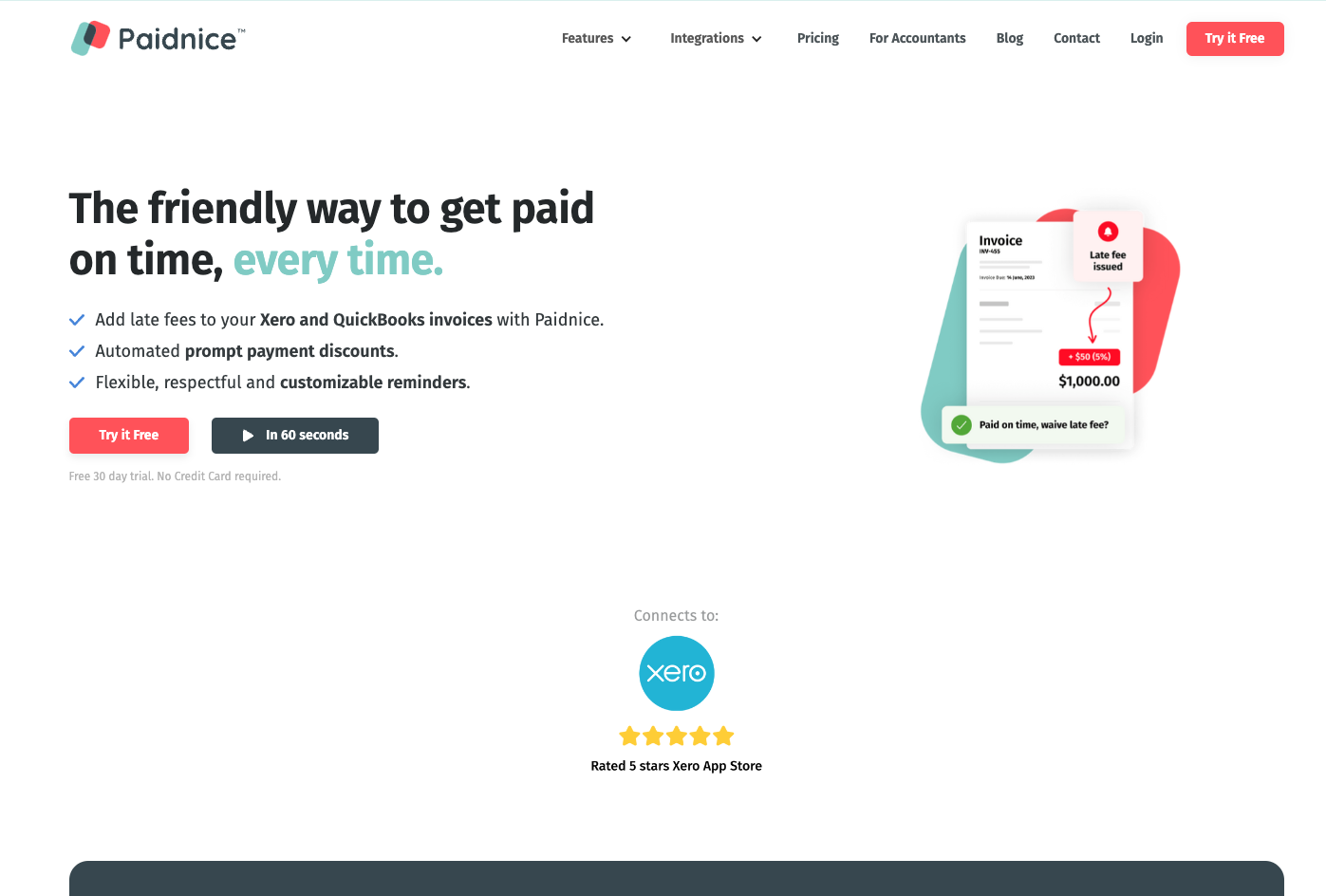

#1 Accounts Receivable Software for Small Business. Get on time, every time with automated late fees, invoice reminders, and prompt payment discounts on your Xero or QuickBooks invoices.

Transform Your Cash Flow with Effective Late Fee Management(#)

Experience the power of Paidnice, a game-changing late fee software that directly addresses the common pain points in financial management. Seamlessly compatible with Xero and QuickBooks, our platform transforms the tedious task of invoice processing into a smooth, efficient process.

Say Goodbye to Overdue Payments

With Paidnice, the frustration of chasing overdue payments becomes a thing of the past. Our enhanced invoice reminders, powered by sophisticated automation and strategic communication, not only remind but also encourage your customers to pay on time, reducing the stress of follow-ups.

Secure Your Cash Flow, Strengthen Customer Relations

Our approach to late fees is more than just penalty enforcement; it's about fostering a culture of timely payments. This strategy not only secures your cash flow but also maintains positive customer relationships, addressing the challenge of balancing firmness with customer care.

Boost Your Revenue with Prompt Payment Incentives

Our prompt payment software is designed to tackle the slow payment issue head-on. By offering attractive early payment discounts, we motivate your customers to pay faster, accelerating your revenue cycle and easing cash flow concerns.

Partner with Us for Financial Peace of Mind

Choose Paidnice and turn your invoice management from a source of stress into a strategic advantage. We're not just a service; we're your partner in creating a more prosperous, hassle-free financial environment, ensuring you get paid on time, every time.

- Paid

- Free Trial

- $19.0 / Monthly (All the automation you need to issue late fees on autopilot)

- Official Pricing

- Xero

- QuickBooks

- Stripe

- Zaper

- Make

- Pinch Payments