-

Share tasks, duties and manage rotations in SlackPricing:

- Paid

- Free Trial

- €3.5 / Annually

#Customer Support #Productivity #SaaS 2 social mentions

-

Learnetto is a place to learn how to make web and mobile apps.

I was part of the beta too for my education site (https://learnetto.com) and I couldn't agree more - Stripe has done a stellar job.

#Education #Maths #Online Learning 3 social mentions

-

Welcome to Medium, a place to read, write, and interact with the stories that matter most to you.Pricing:

- Open Source

#Blogging #Blogging Platform #CMS 2211 social mentions

-

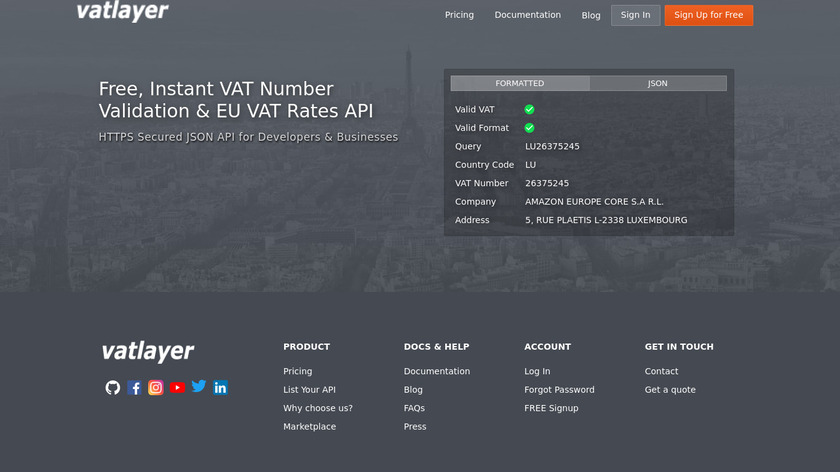

Free VAT Validation & EU VAT Rates API

What makes handling VATMOSS costly for an Saas? I deal with the software end of dealing with VAT for a small company that sells downloadable software and technical support for that software. We've not found it costly at all. It took one guy a couple days or so to get registered with Ireland for VATMOSS. To do the quarterly report for filing, I run a fairly simple script I wrote that produces a CSV file with one row per country giving the total sales and the total VAT we collected for that country, and someone uploads that to a form on the Irish tax authority site, which I understand is a simple and straightforward process. To keep track of VAT rates, we use https://vatlayer.com/ Their API for getting rates is very simple, and their free plan allows 100 API calls per month. It is one call to get the rates for all VATMOSS countries. The reporting script needs to get exchange rates to calculate the VAT in EUR for those sales where the customer paid in GBP or USD. The EU makes that information available in this handy XML document: https://www.ecb.europa.eu/stats/eurofxref/eurofxref-hist-90d.xml That contains the exchange rates between various currencies and EUR for the last 90 days. The rate you want for VATMOSS is the rate on the last business day of the quarter you are reporting for, so there is a little bit of calculation to figure out which day's rate to use. They also have one that gives the most recent day if that better floats you boat: https:///www.ecb.europa.eu/stats/eurofxref/eurofxref-daily.xml If you need a specific range of dates for specific currencies, they've got that covered too. Here it is for USD and GBP: https://sdw-wsrest.ecb.europa.eu/service/data/EXR/D.GBP+USD.EUR.SP00.A Specify the range by adding query parameters startPeriod=YYYY-MM-DD and endPeriod=YYYY-MM-DD.

#Taxes #Tax Compliance #Maths 2 social mentions

Discuss: Stripe Tax

Related Posts

9 Best ManyChat Alternatives & Competitors in 2024

tidio.com // 4 months ago

10 Best Medium Alternatives for Reading and Publishing

geeksforgeeks.org // 6 months ago

25+ Medium Alternative Platforms for Publishing Articles

forgefusion.io // 5 months ago

9 Best Medium Alternatives for Making Money With Your Writing in 2023

authorityhacker.com // 8 months ago

10 Best AI Tools for Customer Service to Elevate Your Support

clickup.com // 7 months ago

14 Best Crypto Tax Software to Ease Your Calculation and Be Compliant

geekflare.com // over 1 year ago