ABLE Loan Management Software

Loan management software for banks, fintech organisations and alternative lenders. End-to-end automation. Component-based loan management system.

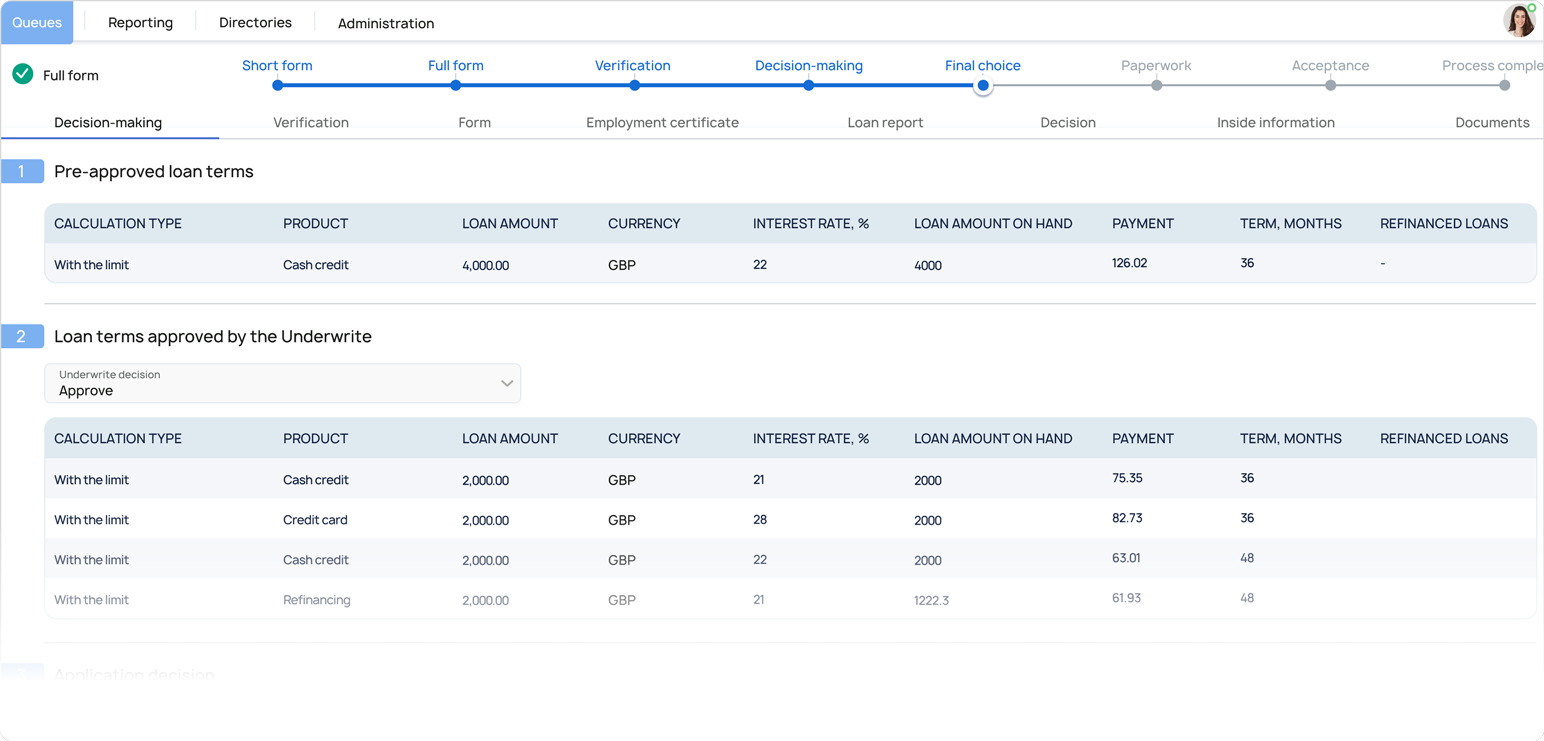

Banking software tailored for classical Banks, Neobanks, FinTechs, MFIs. Streamline your lending processes by automating Loan Origination, Loan Servicing, Debt Collection, Credit Scoring. End-to-end software for Microfinance loans, Auto financing, SME loans, Retail loans, Mortgage loans, Payday loans, P2P loans. You will decrease operational costs while increasing customer flows X6 and more. Banks and MFIs use ABLE Platform to build Retail and SME lending software, Mortgage lending software, P2P Lending software, Payday loan software, Auto loan software, Microfinance loan software, Credit scoring software, Debt collection and recovery software, Loan origination software, Loan servicing software, Loam management software, Loan monitoring software and more.

- Open Source

- Paid

- Official Pricing