How to Take Procurement-Finance Relationship to the Next Level

Posted on June 05, 2022 by Daryna

Traditional scoreboard relationships between procurement and finance built on mistrust, poor communication, and misunderstandings of the supply chain and financial realities have catastrophic consequences for business success.

Lack of communication leads to late payments, inefficient procurement decisions, and overspending, eventually causing financial and reputational business damage.

Needless to say, that smooth collaboration between finance and procurement departments is essential for long-term business success and high organizational performance.

"So how can I develop a strong working relationship between these departments?" you may ask.

You'll find out in this article.

The Role of Finance in Procurement

A finance department is a business unit responsible for receiving and processing any funds on behalf of the organization.

In addition to the traditional roles of managing wages, income, and expenses, the responsibilities of the finance department also include economic analysis to improve key business strategies and advance business objectives.

The finance team sets procurement spending limits and is responsible for paying for everything the procurement team orders and receives.

The task of the procurement team is to adhere to spending limits and save money for the business.

The procurement team must also ensure that the items they ordered are the ones they received and that what they received is what the finance team paid for.

Finance provides spend management reports, revenue reports, and other essential information that demonstrate the company's overall financial health.

Procurement should use these reports to facilitate day-to-day decision-making and financial planning.

With so many vital processes running simultaneously and so much data being created, shared, and managed, it's no surprise that procurement finance collaboration can be challenging.

Why Procurement and Finance Must Work Well Together

In a traditional business structure, procurement and finance are two separate departments that operate independently.

However, it's now clear that although these two business functions are different, the relationship between them is very closely intertwined.

Organizations that allow procurement and finance to operate as partners gain a competitive advantage and often see improvements in day-to-day business operations.

Cooperation between finance and purchasing departments also helps achieve:

- Improved financial reporting, demand planning, and decision-making;

- Strong supplier relationships and overall better supplier quality;

- Increased savings and lower costs;

- Less time-consuming processes;

- On-time payments.

A healthy financial supply chain is also due to procurement and finance working side by side.

When the financial supply chain works well, businesses have enough cash flow to pay for everything from supplies to employee salaries.

This chain relies not only on ideal spending operations but also on proper supplier relationship management and valid procurement choices.

Importance of CPO and CFO Collaboration

It is well known that Chief Financial Officer and Chief Procurement Officer have similar goals in a company.

They both have responsibilities to increase income, reduce costs, and enforce and control business to minimize risks.

By working side by side, procurement and finance can deliver more meaningful results at a higher level, improving business performance.

As CFOs engage in regular dialogue with CPOs, they also become more supportive of funding technologies that CPOs need to enhance their capabilities, such as performance metrics, analytics tools, contract compliance, and vendor analysis.

This is because the teams understand each other's needs and tasks, so when choosing a tool to improve processes, the opinion of each department will be taken into account.

CPO and CFO collaboration also help set the company's priorities correctly, achieve the desired business outcomes and gain transparency across the whole organization.

How to Get Procurement & Finance to Collaborate Well

Procurement and finance teams must work together to support their daily operations and decision-making.

And while most organizations still see them as separate departments, the benefits of their cooperation are hard to overestimate.

Keep reading to learn how you can take the procurement-finance relationship to the next level.

Establish Clear Responsibilities

To facilitate better cooperation between procurement and finance, it's essential to set clear responsibilities for departments' each key activity.

Consider assigning critical tasks to one department based on the team's strengths.

For example, allow the procurement professionals to take the final decision on supplier payment terms.

The procurement team knows better how to maintain good relationships with suppliers and bring their company the best value of working with them.

This approach ensures that no one is arguing over who's in charge, and everyone gets credit for their role.

Align on KPI

Finance and procurement teams must understand each other's goals and their reasoning to bring the most value to an organization.

The purchasing department should be able to determine and understand the return on investment from their decisions and actions. This helps procurement adopt some of the values that drive financial decisions.

The purchasing team can then demonstrate the positive impact they have achieved, for example, by cost reduction or cost avoidance, which supports finance's KPI.

Listen to Each Department's Opinions

Although both procurement and finance are involved in spending, they don't view cost management in the same way.

Finance often sees cost management through the prism of accounts payable, focusing on budgeting, accounting, and invoice processing.

At the same time, procurement focuses more on maintaining supplier relationships, negotiating the best contracts, and strategic sourcing.

Understanding each other's perspectives is essential for having activities aligned, as procurement can work towards contracts and agreements with suppliers that not only add value but also provide cost benefits.

These benefits may include more flexible payment terms and reduced risk, which is usually a high priority for finance.

In turn, finance should help procurement understand the value of efficient supplier onboarding, which helps eliminate payment issues and reduces the risk of fraud.

Establish Clear Standards of Cost Savings Reporting

Interestingly, for procurement, the term "cost savings" usually means a price decrease, while for finance, it relates to a reduction in costs compared to last year's statement.

Yes, these two departments do have different approaches towards this term, but for efficient collaboration, it shouldn't be this way.

Such confusion may lead to finance team members being cautious about procurement claims, as price reduction isn't always reflected in the income statement.

Agreeing on the standards and terminology makes it easier for the departments to work together.

Set Goals Together

Both finance and procurement departments should be involved in setting financial goals to ensure that they're well-designed and realistic.

Poor communication between the teams may cause confusion, inefficient budgeting, and inadequate expense limits.

For example, finances may have no idea how much commodity prices can fluctuate, which can lead to creating unrealistic limitations on procurement spending.

That's why it's critical to discuss decisions related to both departments.

Develop a Clear Inventory Approach

The finance department often uses the inventory line in the balance sheet as an indicator of performance.

Without understanding the nuances of inventory, as procurement does, it's easy for them to feel that the procurement is spending money on goods that simply lie on the shelves in the warehouse.

However, due to demand spikes and supply disruptions, additional stocks are often needed to operate efficiently, and procurement understands this.

Cooperation in this area balances working capital strategy and operational management.

Discuss Cash Flow Strategies Together

Finance and procurement teams' perspectives surrounding payments do not always coincide.

And as they relate to supplier payment terms, these differences can significantly strain supplier relationships.

The finance department usually tends to promote better payment terms for their company, like 90-day payments that make it easier to manage cash flow.

But such terms may not be suitable for suppliers who also have cash flow problems and extended payment periods are not beneficial for them.

The procurement team understands that such decisions complicate supplier management and often lead to higher prices in the form of compensation for lack of timely payment.

In some situations, suppliers may even refuse to do business with your company, so while this may sound like a good option at first glance, it can have serious long-term consequences.

Encourage the CPO and CFO to come together and discuss how the two departments can help make life easier for each other, and then start implementing strategies starting with P2P.

Embrace Technologies for Even Better Productivity

Procurement and finance collaboration can be much more effective if teams are equipped with technologies and techniques that automate flows and centralize data.

Technology enables procurement and finance to:

- Reduce the risks associated with manual work and human errors;

- Improve contract compliance and spend control;

- Manage cash flow and improve supply chain;

- Streamline procurement process;

- Measure supplier performance;

- Minimize payment delays.

A purchasing solution also provides visibility for everything from the approval status to real-time budgets.

Among other things, it allows accounts payable to ensure that they have received all possible discounts, including early discounts due to early or timely payments.

At the same time, backed by technology, the purchasing team can quickly determine which suppliers are preferred for any required service or product and avoid partnering with those who don't offer the best price or value.

When procurement finance work in the P2P system, everyone has access to the necessary information from end to end.

Both purchasing and finance teams can easily check the status of any purchase order or invoice at every stage of the journey, from purchase requisition, through receipt, and to payment.

Choosing the Best P2P Solution

Identifying the tool that best suits business processes, user needs, and stakeholder needs can be exhausting.

Knowing some of the key features to look for in a worthy P2P solution will help make the search more effective and empower your organization to choose a tool that everyone will be happy with.

Here are key things to consider when choosing a purchasing software:

- Customer Support with a long-term commitment to your business;

- Real-time Budget tracking and Reporting;

- Integration with accounting systems/ERP/PM software, etc.;

- Fair and transparent pricing policy;

- Customized approval workflows;

- Expense Management;

- Three-way matching;

- Fast onboarding;

- Ease of use.

Let's look closer at some of the top purchasing software solutions, so you can compare options and choose the best one for your finance and procurement professionals.

Precoro

Precoro is a top solution for small and growing mid-sized businesses. With Package pricing available, it is also an excellent choice for large enterprises.

Precoro offers smart budgeting, streamlined approvals, expense tracking, automated PR, and PO processing — all in one easy-to-use procurement software.

Right now, QuickBooks Online , Xero , and Oracle NetSuite integrations are available, as well as the ability to create custom ones with other business tools.

Kissflow Procurement Cloud

This solution is most suitable for medium-sized businesses. Kissflow isn't difficult to use and will be helpful to the financial team and all employees involved.

The Starter plan supports 100 users at $690 per month. This subscription provides access to purchase requisitions, orders, invoices, budget management tools, multicurrency support, etc.

However, keep in mind that while Kissflow offers a lot of customization options, many features remain too rigid for all employees to enjoy absolute ease of use.

loan-approve.com

Also suitable for mid-sized organizations, loan-approve.com helps gain control and visibility over the purchasing processes.

The solution offers the necessary features for effective spend management. Customers who use loan-approve.com enjoy faster processes overall.

Still, according to GetApp reviews, it's impossible to have multiple balances, and the fees for currency conversion are high.

Lack of customization and poor reporting was also noted as loan-approve.com downsides.

The Power of P2P Integration

Integrating purchasing software with accounting systems and business tools is a must-have for better communication between procurement and finance departments.

It provides transparency for your business expenses, eliminates time-consuming data entry, and reduces manual tasks, as all necessary information is synchronized both in the procurement solution and accounting system.

Everything is matched up whether you create, approve, revise, or cancel Requisitions and Purchase Orders in purchasing software.

Let your CPO and CFO enjoy having constant access to the necessary information.

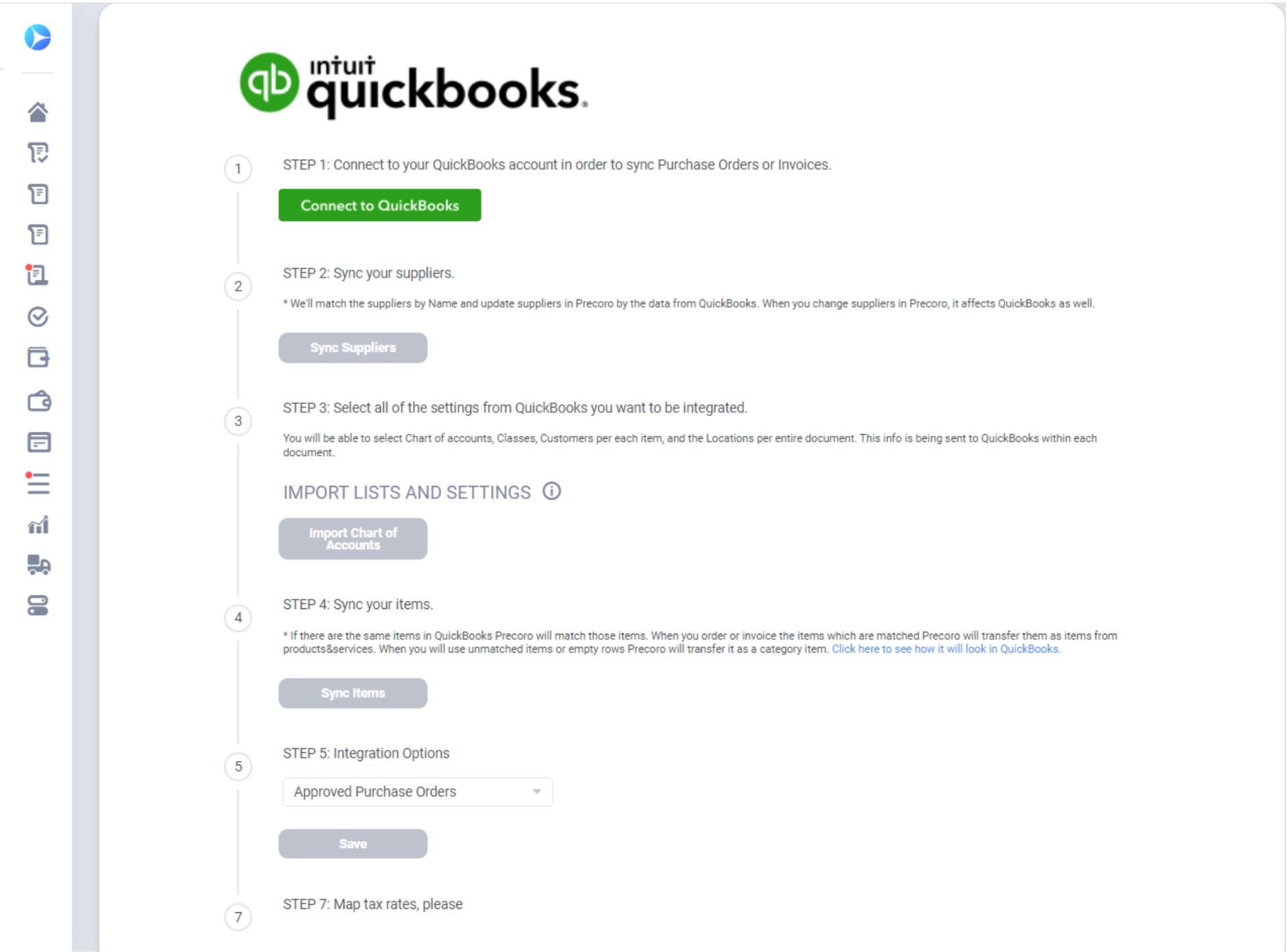

Precoro to QuickBooks Online Integration

Integrating a procurement with an accounting system is quite easy and takes little time.

Let's see how this works on the example of Precoro and QuickBooks Online integration:

Find Configurations and press the Integration tab:

- Press Connect to QuickBooks and login to your account;

- Press Sync Suppliers;

- Select all the QuickBooks settings you want to be integrated;

- Press Sync Items;

- Configure Integration Options;

- Set the default Tax agency and match the tax rates.

As you can see, it's just a 5-minute setup, but it will help you achieve 3x faster workflow.

With Quickbooks Online integration, Precoro clients have products and supplier details available in both systems.

There's no need to enter POs and invoices in QBO manually. All data is automatically transferred from Precoro to QBO for accounting control and paying the bills.

FAQ

What is procurement in finance?

Procurement is the process of obtaining the goods and services needed to support or improve an organization's operations.

It includes finding suppliers or vendors to provide these goods and services, managing supplier relationships, and keeping records used by AP teams.

How does finance help in the procurement process?

Finance pays for everything procurement orders and receives, and procurement adheres to spending limits set by finance while trying to save money for the business.

Finance provides spend management reports, revenue reports, and other essential information procurement uses to facilitate their day-to-day decision-making.

Conclusion

While finance focuses on recordkeeping and budgeting, and procurement priority is complying with the approved supplier list and negotiating the best contracts, their relationship is very closely intertwined.

Procurement and finance alignment helps maintain strong supplier relationships, achieve better savings, and improve financial reporting and decision-making.

- To get procurement and finance to collaborate well, it's essential to:

- Involve finance and procurement departments in setting financial goals;

- Encourage both teams to discuss cash flow strategies together;

- Set clear responsibilities for the departments' each key activity;

- Establish transparent standards of cost savings reporting;

- Develop a unified inventory approach;

- Consider each department's opinion.

Technologies that automate flows and centralize data are also great tools for the departments' productivity.

They reduce human errors, help improve spend control, minimize payment delays, and measure supplier performance.

When procurement and finance work together in the P2P system, everyone has access to the necessary information from end to end.

Both purchasing and finance can easily check the status of any purchase order or invoice at every stage of the journey.

Consider choosing a purchasing software that integrates with accounting systems, as it ensures transparency for your business expenses, eliminates time-consuming data entry, and reduces manual tasks, as all necessary information is synchronized both in the finance and procurement solutions.

About the author