-

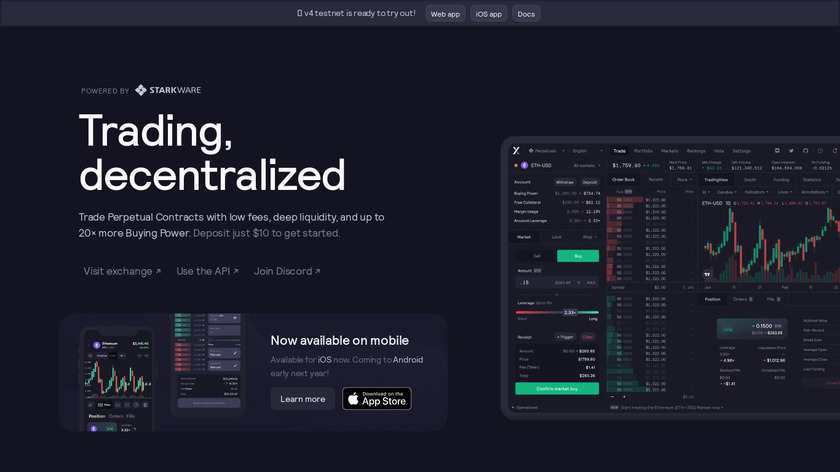

Start trading on #DeFi with low fees and up to 25× leverage.

> Saying “we’ll make it easier to host your own coins” is a bit like saying “we’ll solve the #1 problem with mass crypto adoption”. Sure, I mean, we're still in the "dial-up era" of crypto and a big part of that is wallet UX. But if you're following the space closely, you can see there's been some solid efforts on that front. Rainbow Wallet (https://rainbow.me/) is an iOS & Android wallet that backs up your private keys to iCloud/Google cloud. I think for smaller sums of money and valuables, this is a pretty good solution. Argent (https://www.argent.xyz/) is a smart contract wallet that has a "social recovery" feature that allows you to delegate account recovery to a circle of trusted parties. Gnosis Safe (https://gnosis-safe.io/) is another smart contract wallet that many DAOs use for treasury management, which allows for arbitrary multisig settings to be configured (like requiring 3 out of 5 signers or what have you). Some of these still need work on UX, but the core tech is there. Another factor is blockchain fees. Layer 2s like Arbitrum (https://arbitrum.io/) and Starkware (https://starkware.co/) have already dramatically reduced fees (by as much as 10-20x and will likely get to 1000x reduction by the end of the decade). Once the layer 2s and layer 3s are more mature, it's conceivable that a Coinbase or Kraken could run their own auditable rollup, even if the order book was run on a centralized server, at least the net balances would be held on-chain (Dydx https://dydx.exchange/ works like this currently).

#Crypto #Money #Finance 41 social mentions

-

Uniswap is a decentralized cryptocurrency exchange protocol that enables users to exchange any ERC20 token for any other.Pricing:

- Open Source

We already have functional, audited, open source DEXes and have had them for years now. Uniswap was the first well-done AMM (automated market maker) design. It's on version 3 now, and has traded more than $1.2 trillion in volume: https://uniswap.org/ The smart contracts are posted here: https://github.com/Uniswap/v3-core and can be viewed directly onchain as well: https://etherscan.io/address/0x68b3465833fb72a70ecdf485e0e4c7bd8665fc45 FTX was primarily used for perpetuals trading, which is a type of leveraged derivative product. Popular decentralized perp products include:.

#Finance #Business & Commerce #Productivity 77 social mentions

-

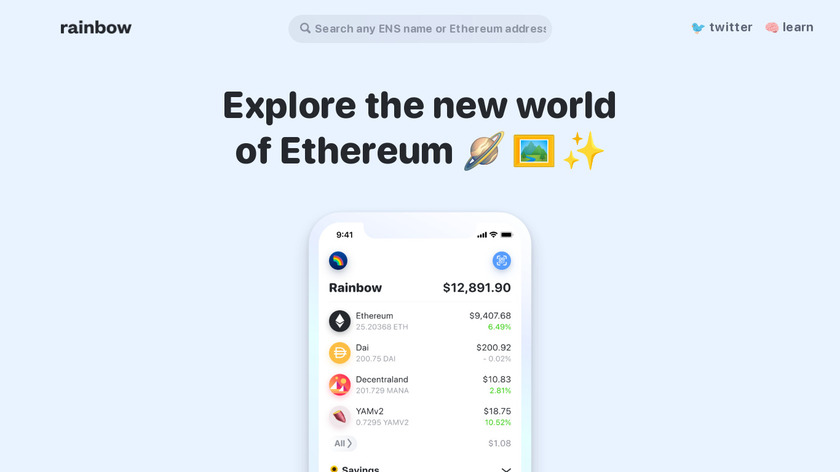

Rainbow Wallet is a digital wallet that helps you manage your crypto assets in a breeze.Pricing:

- Open Source

> Saying “we’ll make it easier to host your own coins” is a bit like saying “we’ll solve the #1 problem with mass crypto adoption”. Sure, I mean, we're still in the "dial-up era" of crypto and a big part of that is wallet UX. But if you're following the space closely, you can see there's been some solid efforts on that front. Rainbow Wallet (https://rainbow.me/) is an iOS & Android wallet that backs up your private keys to iCloud/Google cloud. I think for smaller sums of money and valuables, this is a pretty good solution. Argent (https://www.argent.xyz/) is a smart contract wallet that has a "social recovery" feature that allows you to delegate account recovery to a circle of trusted parties. Gnosis Safe (https://gnosis-safe.io/) is another smart contract wallet that many DAOs use for treasury management, which allows for arbitrary multisig settings to be configured (like requiring 3 out of 5 signers or what have you). Some of these still need work on UX, but the core tech is there. Another factor is blockchain fees. Layer 2s like Arbitrum (https://arbitrum.io/) and Starkware (https://starkware.co/) have already dramatically reduced fees (by as much as 10-20x and will likely get to 1000x reduction by the end of the decade). Once the layer 2s and layer 3s are more mature, it's conceivable that a Coinbase or Kraken could run their own auditable rollup, even if the order book was run on a centralized server, at least the net balances would be held on-chain (Dydx https://dydx.exchange/ works like this currently).

#Finance #Cryptocurrencies #Cryptocurrency Wallets 18 social mentions

-

The first smart contract-based mobile wallet on Ethereum

> Saying “we’ll make it easier to host your own coins” is a bit like saying “we’ll solve the #1 problem with mass crypto adoption”. Sure, I mean, we're still in the "dial-up era" of crypto and a big part of that is wallet UX. But if you're following the space closely, you can see there's been some solid efforts on that front. Rainbow Wallet (https://rainbow.me/) is an iOS & Android wallet that backs up your private keys to iCloud/Google cloud. I think for smaller sums of money and valuables, this is a pretty good solution. Argent (https://www.argent.xyz/) is a smart contract wallet that has a "social recovery" feature that allows you to delegate account recovery to a circle of trusted parties. Gnosis Safe (https://gnosis-safe.io/) is another smart contract wallet that many DAOs use for treasury management, which allows for arbitrary multisig settings to be configured (like requiring 3 out of 5 signers or what have you). Some of these still need work on UX, but the core tech is there. Another factor is blockchain fees. Layer 2s like Arbitrum (https://arbitrum.io/) and Starkware (https://starkware.co/) have already dramatically reduced fees (by as much as 10-20x and will likely get to 1000x reduction by the end of the decade). Once the layer 2s and layer 3s are more mature, it's conceivable that a Coinbase or Kraken could run their own auditable rollup, even if the order book was run on a centralized server, at least the net balances would be held on-chain (Dydx https://dydx.exchange/ works like this currently).

#Cryptocurrencies #Cryptocurrency Wallets #Crypto 50 social mentions

Discuss: Having a safe CEX: proof of solvency and beyond

Related Posts

Top 8 Crypto Swapping Sites/Platforms For 2024; Here’s List

coingape.com // about 1 month ago

5 Top Cryptocurrency Exchange APIs for Developers

bitcoinist.com // 9 months ago

Best Crypto Exchanges in 2024: A Comprehensive Review

blockchainreporter.net // about 2 months ago

Introduction to Crypto Trading Bots

saashub.com // 7 months ago

eToro vs DEGIRO vs Curvo

curvo.eu // 8 months ago

Top 7 Trading Trackers and Journals

cryptowinrate.com // about 1 year ago