-

Guesstimate the possible value of startup options

Https://en.wikipedia.org/wiki/Stock_dilution : > <i>Stock dilution, also known as </i>equity dilution<i>, is the decrease in existing shareholders' ownership percentage of a company as a result of the company issuing new equity.[1] New equity increases the total shares outstanding which has a dilutive effect on the ownership percentage of existing shareholders. This increase in the number of shares outstanding can result from a primary market offering (including an initial public offering), employees exercising stock options, or by issuance or conversion of convertible bonds, preferred shares or warrants into stock. This dilution can shift fundamental positions of the stock such as ownership percentage, voting control, earnings per share, and the value of individual shares.</i> It is reasonable for shareholders to request - in dated written form - Transparency with What-If scenarios for "let's just issue more shares to raise capital". From "Ask HN: Value of “Shares of Stock options” when joining a startup" https://news.ycombinator.com/item?id=19789785 : > <i>There are a number of options/equity calculators:</i> > <i>https://tldroptions.io/ ("~65% of companies will never exit", "~15% of companies will have low exits</i>", "~20% of companies will make you money")* > <i>https://comp.data.frontapp.com/ "Compensation and Equity Calculator"</i> > <i>http://optionsworth.com/ "What are my options worth?"</i> > <i>http://foundrs.com/ "Co-Founder Equity Calculator"</i>.

#Web App #Fintech #Tech 8 social mentions

-

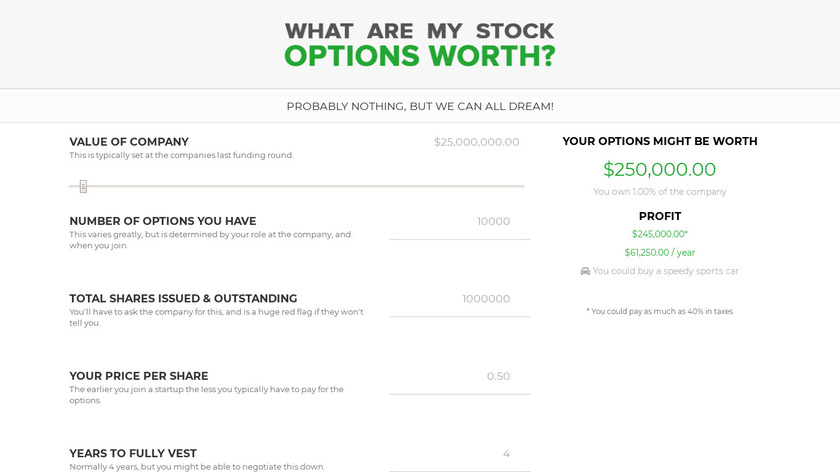

Find out what your stock options are worth

Https://en.wikipedia.org/wiki/Stock_dilution : > <i>Stock dilution, also known as </i>equity dilution<i>, is the decrease in existing shareholders' ownership percentage of a company as a result of the company issuing new equity.[1] New equity increases the total shares outstanding which has a dilutive effect on the ownership percentage of existing shareholders. This increase in the number of shares outstanding can result from a primary market offering (including an initial public offering), employees exercising stock options, or by issuance or conversion of convertible bonds, preferred shares or warrants into stock. This dilution can shift fundamental positions of the stock such as ownership percentage, voting control, earnings per share, and the value of individual shares.</i> It is reasonable for shareholders to request - in dated written form - Transparency with What-If scenarios for "let's just issue more shares to raise capital". From "Ask HN: Value of “Shares of Stock options” when joining a startup" https://news.ycombinator.com/item?id=19789785 : > <i>There are a number of options/equity calculators:</i> > <i>https://tldroptions.io/ ("~65% of companies will never exit", "~15% of companies will have low exits</i>", "~20% of companies will make you money")* > <i>https://comp.data.frontapp.com/ "Compensation and Equity Calculator"</i> > <i>http://optionsworth.com/ "What are my options worth?"</i> > <i>http://foundrs.com/ "Co-Founder Equity Calculator"</i>.

#Investing #Fintech #Finance 1 social mentions

Discuss: Ask HN: Why don’t startups share their cap table and/or shares outstanding?

Related Posts

10 Best Image Hosting Sites for Personal and Business Purposes

techgeekbuzz.com // almost 3 years ago

11 Best Image Hosting Sites for Personal to Business

dailytechmap.com // almost 2 years ago

20 Websites Like DeviantArt {2021}

techtricksworld.com // over 2 years ago

13 Best DeviantArt Alternatives & Similar Sites

regendus.com // almost 2 years ago

Top 10 Killer Deviantart Alternatives for Art Communities

acethinker.com // about 2 years ago

Top 15 Best Alternatives To Tinder – It’s 2022!!

bonobology.com // about 3 years ago