-

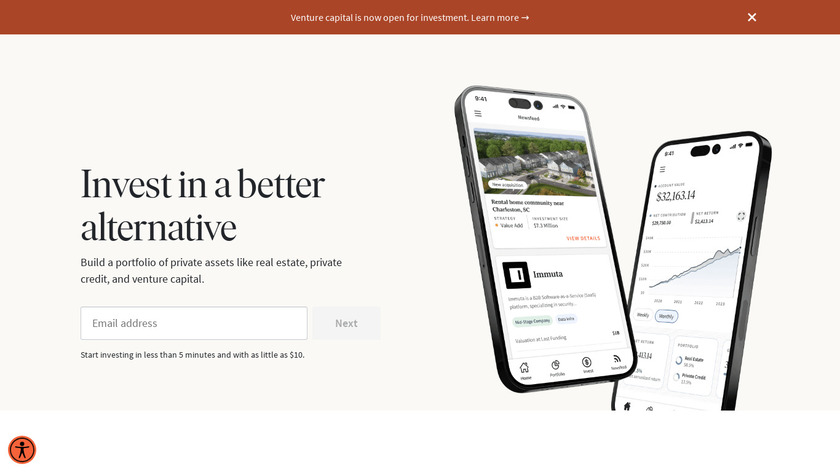

The first low-cost private market investment advisor

I've found that careful accredited investor real estate deals can consistently provide returns close to owned real estate with less hassle and with less risk. For these types of deals you can look at sites like realtymogul.com, crowdstreet.com, fundrise.com, and realcrowd.com. There are more of these and there are also sites that are developer sites that have similar offers. I use these for real estate deals. I have 12+ active now and have more than that have been closed out (most of my deals in this category are 3 to 7 years). My experience is a net 20% annual return. With rare exception, I don't do the ones that are a pool of properties (nothing wrong with this) but rather single property deals. The single property deals are easier for me to analyze and where I can add value to the decision process because I might know about the specific market or property. Unless you have some background in this, you should scale slowly as you learn how to size and choose. I think here you learn by doing.

#Fintech #Real Estate Management #Investing 26 social mentions

-

Diversify your portfolio with commercial real estate investments on the CrowdStreet platform. Start building wealth today.Pricing:

I've found that careful accredited investor real estate deals can consistently provide returns close to owned real estate with less hassle and with less risk. For these types of deals you can look at sites like realtymogul.com, crowdstreet.com, fundrise.com, and realcrowd.com. There are more of these and there are also sites that are developer sites that have similar offers. I use these for real estate deals. I have 12+ active now and have more than that have been closed out (most of my deals in this category are 3 to 7 years). My experience is a net 20% annual return. With rare exception, I don't do the ones that are a pool of properties (nothing wrong with this) but rather single property deals. The single property deals are easier for me to analyze and where I can add value to the decision process because I might know about the specific market or property. Unless you have some background in this, you should scale slowly as you learn how to size and choose. I think here you learn by doing.

#Real Estate Management #Real Estate CRM #Alternative Investment 5 social mentions